BUYERS HUB

The Home Buying Process

Buying a home doesn’t need to feel overwhelming. Our Buyer Services Hub walks you through each step — from getting pre-qualified, touring homes, and making offers, to inspections, appraisals, and closing day. We simplify the process and make sure you know what to expect before, during, and after your purchase.

Financing Options That Work for You

Every buyer’s situation is unique. That’s why we help you compare loan programs available in Kentucky — FHA loans with as little as 3.5% down, USDA loans with zero down in qualifying areas, VA benefits for veterans, and conventional loans with competitive rates. Our goal is to match you with the financing option that fits your budget and timeline.

Understand the True Costs of Buying

Beyond the down payment, buyers in Kentucky should be prepared for closing costs, inspections, appraisals, and prepaid items like taxes and insurance. We’ll help you understand what’s required, what’s optional, and what local programs can offset costs — so there are no surprises when you get the keys.

Local Knowledge, Trusted Guidance

Our agents live and work in the communities we serve. From London and Corbin to Mt Vernon and all across the entire state of Kentucky, we provide local insight that online search tools can’t match. When you work with Williams Elite Realty, you’re backed by a team that knows the neighborhoods, the market, and the people,

Why Buyers Choose Williams Elite Realty

We’re more than just REALTORS® and Real Estate Agents — we’re Keepers of the Pride. That means we protect your interests, celebrate your wins, and stand by you Beyond the Closing. Our mission is simple: to help Kentucky buyers find not just a property, but a place to thrive.

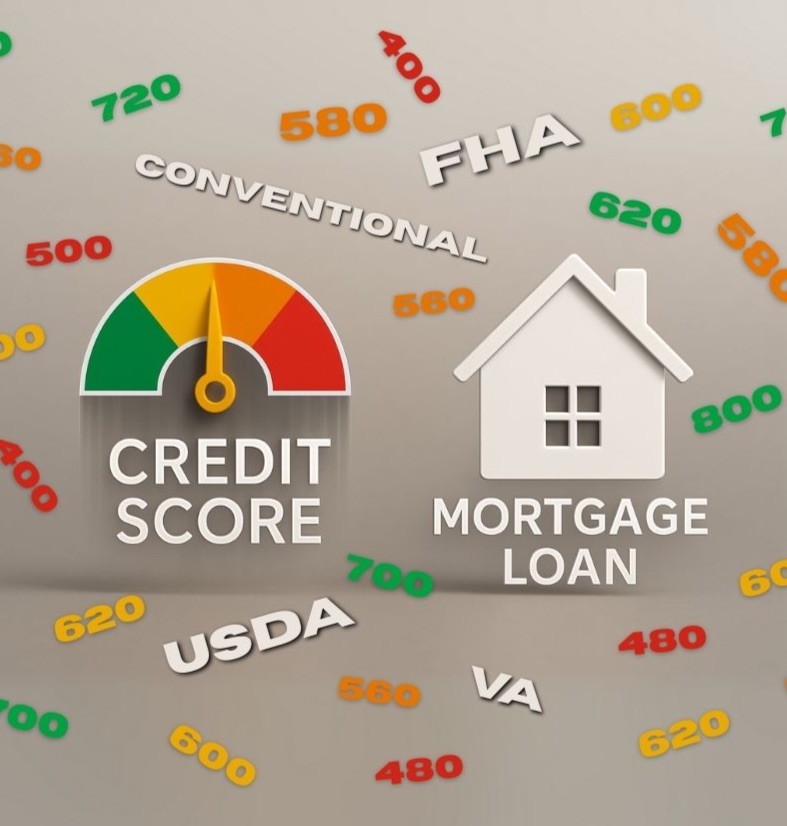

Credit Score and Loan Approval

Your credit score plays a big role in the type of loan you qualify for and the interest rate you receive. Even if your score isn’t perfect, we’ll connect you with trusted lenders who can review your situation, suggest improvements, and help you take the next step toward homeownership.

Financing Options That Work for You & Minimum Credit Score Requirements

Every buyer’s financial situation is unique, and the right loan can make all the difference. At Williams Elite Realty, we help you compare financing options available in Kentucky so you can choose the one that best fits your budget, lifestyle, and long-term goals.

See our Financing Options Page for more Details and find the right Mortgage for you.

See our Financing Options Page for more Details and find the right Mortgage for you.

•FHA Loans and Minimum Credit Score

Ideal for first-time buyers, FHA loans allow down payments as low as 3.5% with qualifying credit scores, making homeownership more accessible. FHA Mortgages allow scores as low as 580 with a 3.5% down payment. Some lenders may even consider lower scores with larger down payments.

•USDA Loans and Minimum Credit Score

Often miss-labled as "First Time Home Buyers Loan" While meany First time bueyrs take advantage of the USDA Program, You dont have to be a First time home buyer to use a USDA Mortgage to purchase your home. It's Perfect for buyers in eligible rural areas across Kentucky, USDA loans offer 0% down payment and affordable monthly payments. USDA loans usually require a 620+ score, though lenders may set their own minimums.

•VA Loans and Minimum Credit Score

Available to veterans, active-duty service members, and eligible military families. VA loans offer no down payment and flexible credit requirements. There is no official minimum score set by the VA; most lenders, however look for around 620, but exceptions are possible.

•Conventional Loans and Minimum Credit Score

Best for buyers with strong credit profiles. Conventional financing provides competitive rates and flexible terms for those who qualify. Typically Conventional Mortgages require a credit score of 620 or higher for approval, with the best rates going to buyers above 740.

•Down Payment Assistance (DPA) Loan and Minimum Credit Score

Down Payment Assistance (DPA) Loans - Many first-time buyers in Kentucky may qualify for state or local assistance programs that help cover part of the down payment or closing costs, making it easier to get into a home with less upfront cash. The minimum credit score requirements can vairy depeding on the program or lending instution. Commonly, expect around a 620+ score to qualify.

•Rehab and Renovation Loans and Minimum Credit Score

Rehab and Renovation Loans - FHA 203(k) and similar renovation loan programs allow you to finance the purchase price plus repair or upgrade costs into one mortgage. A great option for buyers considering fixer-uppers or properties needing improvements. The minimum credit score requiremnts can vairy greatly depending on the type of rehab loan. On the low end it can be as low as 550 and on the higher end a score of 660 can be the minimum. There are also "Hard Money Loans" that may not have a minimum credit score requirment.

Visit our Financing Options page for more Details on these Mortgage Loan Programs and find the right Loan for you. You can also visit our Credit Score to Buy A Home page for more detailed information on Credit Scores and practices to improve your credit score.

Start Your Home Buying Journey — Get Pre-Qualified Today!

|

Local Knowledge, Trusted Guidance

|

Work With Us: Meet the Williams Elite Realty Team